Accounting Rate of Return Definition, Formula Calculate ARR

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

What is the average rate of return (ARR) formula?

For a project to have a good ARR, then it must be greater than or equal to the required rate of return. The company may accept a new investment if its ARR higher than a certain level, usually known as the hurdle rate which already approved by top management and shareholders. It aims to ensure that new projects will increase shareholders’ wealth for sustainable growth.

Cost reduction projects:

Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance. HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. Get granular visibility into your xero shoes military discount march 2021 accounting process to take full control all the way from transaction recording to financial reporting. Therefore, the implied ARR multiple at which Hebbia raised its Series B funding comes out to approximately 54x, reflecting the market size and revenue opportunity of the one of the top Gen AI startups at present. Hebbia, founded by George Sivulka in 2020, reportedly generated $13 million in ARR while raising institutional capital from venture capital (VC) firms.

Example of the Accounting Rate of Return (ARR)

Investment evaluation, capital budgeting, and financial analysis are all areas where ARR has a strong foundation. Its adaptability makes it useful for a wide range of applications, including assessing the economic profitability of projects, benchmarking performance, and improving resource allocation. The accounting rate of return (ARR) formula divides an asset’s average revenue by the company’s initial investment to derive the ratio or return generated from the net income of the proposed capital investment. Companies might decide to figure out their Annual Recurring Revenue (ARR) based on their unique requirements. However, it’s common for businesses to calculate their ARR annually, particularly those with standard one-year contracts.

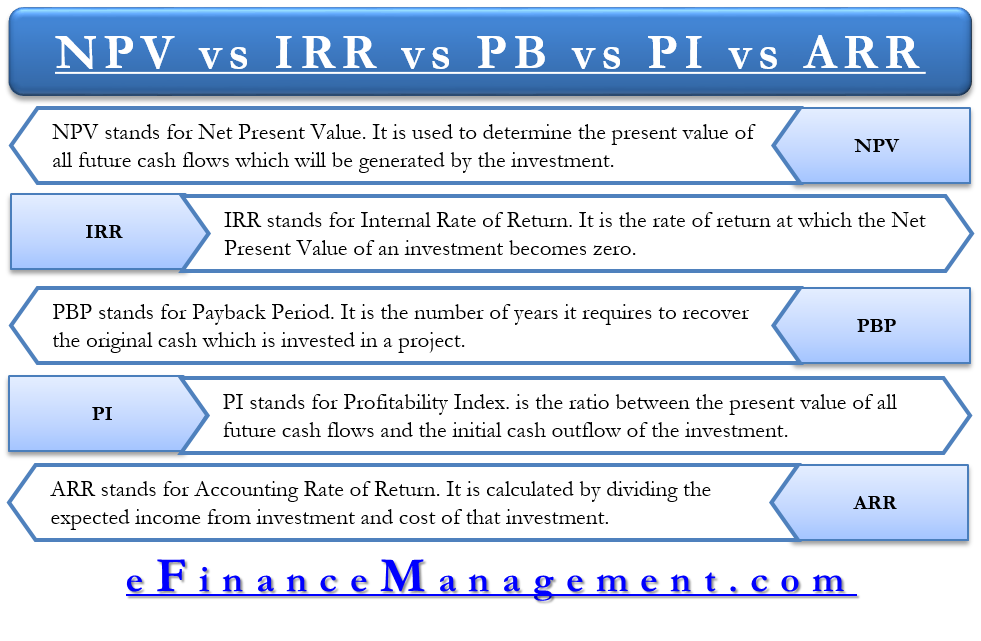

Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow. The annual recurring revenue (ARR) reflects only the recurring revenue component of a company’s total revenue, which is indicative of the long-term viability of a SaaS company’s business model. Whether it’s purchasing property, investing in a new software training program, or expanding into a new market, there are many investment decisions that businesses must make.

Accounting Rates of Return are one of the most common tools used to determine an investment’s profitability. It can be used in many industries and businesses, including non-profits and governmental agencies. Based on the below information, you are required to calculate the accounting rate of return, assuming a 20% tax rate.

This way, you avoid any interruption in your cash flow by ensuring you don’t provide products and services to these customers until they settle their overdue payments. Free trials are another factor that should not be included in the ARR calculation. They do not contribute to recurring revenue, and their inclusion could lead to errors.

- While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations.

- However, one-time payments do not count as recurring revenue because they do not guarantee repetition.

- The calculation of ARR requires finding the average profit and average book values over the investment period.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Grasping the details of ARR calculation might seem complex, but adopting the right practices makes it easier.

- These reports categorize your unpaid customer invoices by their outstanding duration, making it easier to identify late payers.

But accounting rate of return (ARR) method uses expected net operating income to be generated by the investment proposal rather than focusing on cash flows to evaluate an investment proposal. Kings & Queens started a new project where they expect incremental annual revenue of 50,000 for the next ten years, and the estimated incremental cost for earning that revenue is 20,000. Based on this information, you are required to calculate the accounting rate of return. The Accounting Rate of Return (ARR) provides firms with a straight-forward way to evaluate an investment’s profitability over time. A firm understanding of ARR is critical for financial decision-makers as it demonstrates the potential return on investment and is instrumental in strategic planning.

This is when it is compared to the initial average capital cost of the investment. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. Since ARR is based solely on accounting profits, ignoring the time value of money, it may not accurately project a particular investment’s true profitability or actual economic value. In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability.

Keeping your ARR accurate requires regular monitoring and adjustment of your calculations. Correctly accounting for discounts and churn in your ARR calculation is crucial. It dramatically impacts the accuracy of your revenue forecast and, consequently, the path of your SaaS business. ARR is the yearly revenue from subscriptions, contracts, and other recurring billing cycles. It’s a main measurement for evaluating the year-on-year growth of SaaS and subscription businesses that use a recurring revenue model. Recurring revenue streams are essential for forecasting your company’s growth.